Can financial controllers modernize their accounts payable systems without bringing daily workflow to a halt?

BLOG

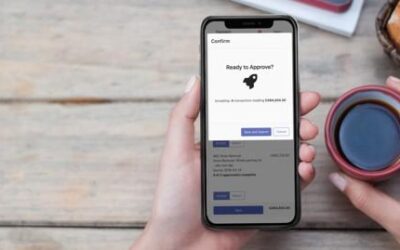

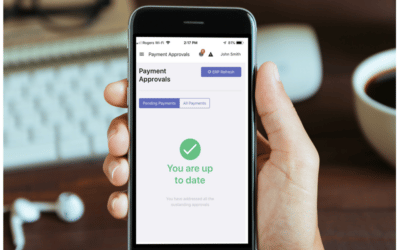

Modernising Board Approvals for the Mobile Era

How often do crucial business decisions face unnecessary delays due to outdated approval processes? In today’s dynamic business environment, the speed and precision of decision-making are crucial for maintaining competitiveness and operational fluidity. This holds especially true for essential financial operations like Accounts Payable, where the need for board approvals can often create bottlenecks, slowing down the entire process and potentially straining relationships with vendors. Many organizations continue to rely on traditional, paper-based systems, inadvertently introducing inefficiencies that modern technology is well-equipped to eliminate. The friction caused by these manual methods extends beyond mere inconvenience, impacting financial health and the overall agility of a business.

Building Consensus: How to Secure Team Buy-In for Accounts Payable Automation

How can organizations ensure new financial technologies, like Accounts Payable automation, are embraced by every member of their team, rather than met with resistance?

Automating Accounts Payable: A Path to Stronger Vendor Partnerships

How much do the complexities of traditional payment processes truly impact your business relationships with vendors?

Many businesses grapple with significant challenges in their accounts payable operations, frequently leading to sluggish payment processing, communication breakdowns, and strain on crucial supplier relationships.

Is Your Business Protected? Essential Security Features for Digital Accounts Payable

As businesses increasingly transition to digital operations, a crucial question arises: how well are their financial transactions protected within automated accounts payable systems?

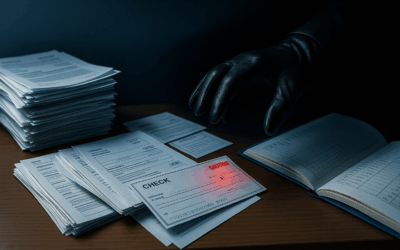

Why Manual Payables Leave You Exposed to Payment Fraud

In today’s fast-paced business world, efficiency and security are non-negotiable. Yet, many businesses still rely on outdated, manual accounts payable (AP) processes. While these legacy systems might feel familiar, they are, unfortunately, a siren call for fraudsters.

SparcPay announces Integration with Yardi, further supporting SparcPay expansion into the US market.

SparcPay, a leading provider of digital approval and payment solutions, is excited to announce its seamless integration with Yardi, the premier property management software platform. This integration empowers property managers to transform their accounts payable process into a fully paperless, automated workflow—often in as little as 2–4 weeks with no upfront costs.

10 Signs Your Payables Process Is Costing You More Than You Think

Managing accounts payable might seem like just another back-office task—but if your payables process is inefficient, it could be costing your business far more than you realize. Manual approvals, paper checks, and disjointed workflows can silently erode profitability,...

Is Your Property Management Company at Risk for Check Fraud? Use Our 10-Point Checklist to Find Out

Check fraud is on the rise — and property management companies are prime targets. With high payment volumes, multiple approvers, and often outdated paper-based processes, the risk of financial loss is real. Use this 10-point checklist to evaluate your payment...

Empowering Remote Teams: AP Automation in the Era of Hybrid Work

The rise of hybrid and remote work has transformed the way businesses operate. As teams spread out across cities, provinces, and even countries, the need for digital collaboration tools has never been more critical—especially in the world of finance. One area that has...

Building Stronger Vendor Relationships Through Efficient AP Practices

In any business, vendor relationships are essential. Your suppliers, contractors, and service providers help keep your operations running smoothly—and the way you manage accounts payable (AP) can directly impact the strength of these relationships. Late payments,...

Streamlining Invoice Processing with AP Automation

Optimizing Your AP Workflow for Efficiency and Accuracy Accounts payable (AP) teams face increasing pressure to process invoices efficiently while maintaining accuracy and compliance. Traditional invoice processing methods—paper-based approvals, manual data entry, and...

Ensuring Compliance and Security in AP Automation

Why Compliance and Security Matter in AP Automation Automating accounts payable (AP) processes has revolutionized how businesses manage invoices, approvals, and payments. It enhances efficiency, reduces errors, and speeds up transactions. However, as with any...

The Role of AI in Accounts Payable Automation

How AI is Transforming Accounts Payable Artificial intelligence (AI) is revolutionizing the way businesses manage their financial operations, and accounts payable (AP) is no exception. AI-driven solutions are enhancing efficiency, improving accuracy, and streamlining...

Enhancing Supplier Relationships through AP Automation

In today’s fast-paced business environment, maintaining strong supplier relationships is crucial for long-term success. A company’s ability to pay its vendors accurately and on time directly impacts trust, collaboration, and financial health. However, traditional...

Safeguarding Your Condo Corporation from Cheque Fraud

Cheque fraud is on the rise - costing organizations millions of dollars each year. Unfortunately, condominium corporations are not immune. In fact, their reliance on cheques for vendor payments and other transactions makes them especially vulnerable. The consequences...

Calculating the ROI of AP Automation

Accounts payable (AP) automation is becoming a necessity for businesses looking to streamline their financial operations. However, before investing in an AP automation solution, decision-makers need to evaluate its return on investment (ROI). By understanding the cost...

Overcoming Common Challenges in AP Automation

Automating accounts payable (AP) processes can significantly enhance efficiency, reduce errors, and streamline payment workflows. However, businesses often encounter obstacles when implementing AP automation. Understanding these challenges and their solutions is...

Accounts Payable Automation Best Practices: Optimizing Efficiency and Accuracy

In today's fast-paced business environment, accounts payable (AP) automation has become essential for companies looking to optimize efficiency, reduce errors, and streamline financial workflows. Manual AP processes are often time-consuming, prone to human error, and...

Top Trends in Accounts Payable Automation for 2025

The Future of AP Automation: What to Expect in 2025 The world of accounts payable (AP) is evolving rapidly, driven by emerging technologies and increasing demands for efficiency. As businesses seek to streamline their financial processes, AP automation is becoming a...

How the Canada Post Strike Will Disrupt Payments

With the indefinite Canada Post strike impacting postal services across Canada, businesses are facing new challenges, particularly when it comes to mailing cheques for payments. The strike disrupts the reliability of traditional mail, which many businesses still rely...

The Future of B2B Payments: Key Trends for 2024

In the rapidly evolving landscape of business-to-business (B2B) payments, staying ahead of payment trends is crucial for companies aiming to maintain a competitive edge. As we move through 2024, several key trends are shaping the way businesses handle their payment...

Protecting Condo Boards: The Perils of Cheque Payments and the SparcPay Solution

In an age where digital transactions dominate the financial landscape, it's surprising how prevalent the use of cheques still is, especially among condo boards. What seems like a traditional and secure method of payment can actually leave condos vulnerable to...

Streamlining HOA Finances: The Case for ACH Payments with SparcPay

In the realm of property management and homeowners association (HOA) governance, efficiency is key. As property managers and HOA board members juggle numerous responsibilities, from maintaining properties to managing finances, adopting streamlined payment methods is...

How Digital Payments are Changing Accounts Payable for Property Managers and Condo Boards

In the fast-paced world of property management, efficiency and security are paramount, and traditional paper-based accounts payable processes are a potential source of risk. Condo board members and property managers are increasingly realizing the vulnerabilities...

Restaurant supplier payments go digital with the SparcPay app for Clover

SparcPay, a leading innovator in digital payments for small businesses, is thrilled to announce the official launch of the SparcPay app for Clover. With its user-friendly interface and advanced features, the SparcPay app offers a simple, secure, and faster way for...

Payment logistics: Why an automated accounts payable system is a must for the Logistics Industry

Many logistics companies have seasoned executives at the helm. This level of experience and loyalty is invaluable to any industry, but the downside is that it creates a deep comfort in the way things have always been done. Because of this, there has been a general...

Finding the Best Bill Payment System for Your Church’s Finances

When operating a church or any other non-profit organization, you face unique challenges compared to most other businesses. Oftentimes, key signing members are not available every day due to other time commitments, your administration staff may be made up of...

Top 5 Advantages of Automating Accounts Payable

Digital transformation is nothing new; while businesses have been implementing digitized systems for years, accounts payable automation is one area that has been met with resistance. For many business owners, there’s a comfort in being able to hold a paper bill in...

What makes SparcPay the top AP automation software

Over the past several decades, our lives—and businesses—have become increasingly digitized. This has led to us all juggling a patchwork of apps and services to manage our tasks and complete them on time. After fumbling through using the many tools available ourselves,...

SparcPay Introduces End-to-End Xero Account Payable Automation at Xerocon

We are thrilled to announce that SparcPay is now an official Xero partner and is available in the Xero app store. Trusted by over 3 million subscribers globally, Xero provides online accounting software that makes it easier than ever to run your business. Seeing as...

SparcPay’s Payment Processing for Restaurants

Processes related to running a restaurant have become increasingly digitized over the past decade – and both restaurants and staff have benefited greatly from these new technologies. From point-of-sale and front-of-house systems that run on iPads, to online...

Vendors Love Getting Paid by SparcPay

Vendors getting paid by cheque “The cheque’s in the mail.” Who in accounts receivable hasn’t heard that threadbare line? And why is it uttered so often by clients to vendors seeking to square up accounts? There are a few reasons: Clients haven’t actually paid and are...

Virtual Approval—Anytime, Anywhere, Any Device

Here’s a staggering stat for you: In North America each year businesses lose over $75 billion to payment friction. A good chunk of this friction is generated by the processing of invoices using conventional analog accounts payable methods. According to industry...

Goodbye Cheques, Hello SparcPay!

Disadvantages of cheques Many organizations would be surprised—possibly even shocked—to know just how much time its employees spend each month writing, processing, sending and verifying cheques. Time is spent loading the printer with cheque stock, printing the...

SparcPay’s Seamless Integration with QuickBooks Desktop

Intuit is making a big push to transition QuickBooks users from desktop versions to the cloud-based QuickBooks Online. However, many accountants are loyal to QuickBooks Desktop - aka QBD - Intuit's locally installed legacy accounting software. To ensure that...

SparcPay – A Grocery Store Payment Software Solution

Grocery stores stock a myriad of goods from multiple suppliers, all of whom need to be paid—a process that, using conventional operating systems and manual processes, is time consuming and costly. The SparcPay app saves grocery stores time and money paying their...

SparcPay Integration With QuickBooks Online

QuickBooks is an accounting software package developed and marketed by Intuit, an American business software company. First introduced in 1983, QuickBooks products are geared mainly to small- and medium-sized businesses. QuickBooks has on-premises accounting...

SparcPay: The Premier Accounts Payable app for the Construction Industry

The construction industry in North America is booming—and there’s no end in sight given the drastic shortage of housing in so many jurisdictions. For some construction companies, however, the ability to scale up their operations to meet demand is compromised by the...

SparcPay For Accountants & Bookkeepers – The Efficient Accounts Payable Process

SparcPay for accountants and bookkeepers is a no-brainer. Why wouldn’t these professionals want an integrated, secure, digital solution that: Allows for complete review and approval of bills via web and mobile from anywhere.Eliminates paper from the entire accounts...

SparcPay—An Automated Payment System for Business

In far too many small- and medium-sized enterprises, fundamental business operations and accounting processes are beset with friction—the force that resists motion. Operations and processes subject to friction move slowly and sometimes grind to a halt. Friction can be...

Paperless Property Management With Sparcpay: The Easy To Use Property Management Payment Software

Paper Bills and Cheques At SparcPay we’re straight shooters. We value transparency and call it as we see it, which is why we’re not hesitant to remind you that, in the words of Nobel Prize laureate Bob Dylan: The upshot of this message is that if you don’t adapt to...

What Is An Audit Trail And What Are Its Benefits?

An audit trail is a system of recordkeeping that ensures that all steps of a financial transaction are physically and/or digitally documented, thereby establishing the transaction’s legitimacy. Without an audit trail, a financial transaction is, at best, suspect, and...

Millions In Government Grants Efficiently and Safely Disbursed to Small Businesses using SparcPay

When Small Business BC (SBBC) was selected as a delivery partner for British Columbia’s $300 million Business Recovery Grant to help businesses cope in the wake of the COVID-19 pandemic, they had to quickly ramp up the systems required to fulfill their role in the...

Sparcblock Selected By Intuit Prosperity Accelerator

The Intuit Prosperity Accelerator is a partnership between Intuit Canada and Highline Beta, where a cohort of global seed-stage tech startups will help solve specific pressing financial prosperity challenges that Canadian consumers, self-employed and small businesses...

Shiftsuite Users Gain an Unfair Advantage With Safe And Convenient Paper Payables

Paperless payables create an unfair advantage in property management. Available with the world's best condo software ecosystem, Shiftsuite, digital approval and payment is an experience that is safe, convenient and environmentally friendly. It’s powered by SparcPay,...

Paperless Payables Are A Game Changer For Malvern Condominium Management

Malvern Condominium Property Management implemented SparcPay to save time, and provided their clients with an exceptional user experience with more transparency and financial control. SparcPay met all of their expectations, and also enabled them to do more work...

The Meritus Group Leads With Contactless Payments

The Meritus Group, a leading property management company switched to digital approval and payment to replace outdated paper payables processes. "When we launched SparcPay one of the advantages was the protection of managers and board members. By minimizing the paper...

Working Virtually When You Have Signing Authority

Social distancing, self-isolation, and working remotely are important tools to protect our communities from the spread of COVID-19. What about those people that have cheque signing authority - can they maintain these practices while still making the payments that are...

It’s 2020 – Can You Let Go Of The Cheque Now?

It's hard to let go of the cheque! According to the latest Payments Canada report, organizations still write 460 million commercial cheques in Canada each year. That's down slightly, but still a huge number. It spells opportunity for organizations to save money by...

Convenience and Control

City Sites Property Management, a leader in providing creative solutions for property management, was also the first property management company in Canada to implement SparcPay as a value added service which is now available to all their clients. Their Vice-President,...

Attention Board Members

If your association, church or non-profit is still asking board members to sign cheques, why not try SparcPay - a secure digital approval and payment app that saves time and money. Please share this to others you know that serve on volunteer boards...

Earth Day

Canadian businesses and not-for-profit organizations consume 75,000 trees per year issuing paper cheques to suppliers. Being good to the earth is also good for your bottom line - paperless payments save over 50% in transaction costs.

It’s Time to Stop Signing Cheques

How many of us still refer to an encyclopedia, look up a number in a phone book, or get directions from a paper map? For that matter how many of us still use personal cheques to pay bills? We stopped using these obsolete tools years ago, or are too young to have ever...

AMJ Campbell Moves First With Blockchain Technology

AMJ Campbell, Canada’s largest mover, is also a first-mover with blockchain technology to streamline and secure their accounting processes, having successfully transitioned from paper cheques to a paperless digital payables process using blockchain. "Blockchain is a...